(Excerpt from Taylor Pearson’s Interesting Times 3 Jul 2020)

Let’s say you have the opportunity to play a very attractive game. You flip a coin. If you get heads, you get six times your wager back. If you get tails, you lose your initial wager. You start with $100 and you can play this game up to 4 times.

How much should you wager on each flip? If you wager everything, you could get unlucky and lose it all on the first flip. However if you wager too little, you won’t maximize your earnings.

In this instance, where you know the odds a priori, there is a mathematical formula known as the Kelly Criterion to calculate the correct amount to wager to maximize your long-term wealth.

The general idea behind the Kelly Criterion is that you wager more or less depending on how much “excess information” or “edge” you have. If you know something about the probability of a pharmaceutical company coming out with a new drug, then that equates to potential excess returns. The larger the edge, the more aggressively you should bet.

In this game, your edge is a whopping 200 percent. (For every dollar you bet, you stand a 50 percent shot at getting $6. That is worth $3. The average gain is $2 on $1 staked, or 200 percent of the original wager.) The payoff odds of this wager are 5 to 1. That means that the Kelly wager, edge/odds, is 2/5, or 40 percent of your bankroll.

So, the correct amount to maximize long-term growth in this game is to bet 40% of your bankroll each round.

Let’s say 16 different people start playing this game, all using the exact same betting methodology. How different do you think the outcomes would be? We know the odds of the coin flip already and we know how much everyone is going to bet so they are all going to end up with about the same amount of wealth at the end right?

Not really.

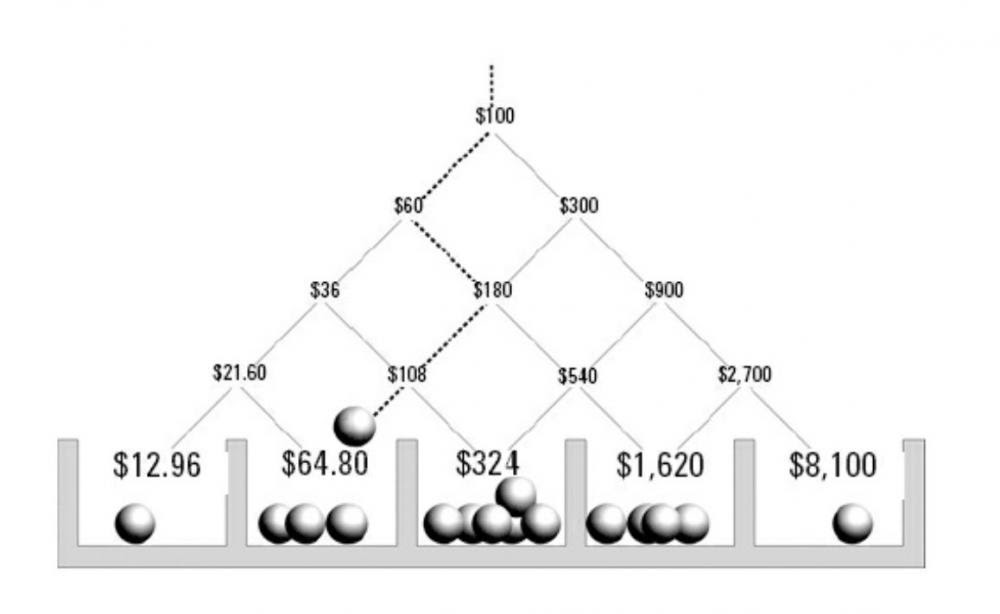

This diagram shows every possible scenario through four tosses.

In a very lucky scenario, your $100 becomes $8,100. Pretty awesome! In a very unlucky scenario, your $100 becomes $12.96.

If you’re like most people, there is something a bit unsettling about these outcomes. There is such a huge disparity between the person who does the best and the person who does the worst.

Also, remember that everyone had exactly the same odds and exactly the same “talent” in terms of picking the right amount to wager.

Even if every participant is equal, the terminal wealth distribution will result in a great deal of inequality between participants.

There are many games in our own lives or in society at large that behave like this. One key difference, of course, is that the odds are not equal in reality. However, I think this very simple model is helpful for thinking about just how much of a roll luck plays in our lives.

If 16 entrepreneurs started companies at the same time and one produced an 81x return, four produced a 16x return, 6 produced a 3x return, and 5 of them went out of business, we would tend to think that, sure, there is some luck involved but clearly the 16x and 81x entrepreneurs are better than the ones who went bankrupt, right?

However, as this thought experiment shows us, it’s possible that all of those entrepreneurs were equally talented, hard-working, and made equally good decisions about their companies. They just had different amounts of luck.

Pretty much everyone would agree with some version of:

Outcomes = hard work x talent x luck.

If you work hard and are talented and get lucky then you’ll do well. If you are lazy, never learn skills, and get unlucky, you’ll do poorly. That seems pretty obvious.

What is less obvious is that it’s more common than we think for someone to work hard and be talented but get unlucky and end up with a pretty bad outcome.